Access to third-party funding is becoming a key tool for businesses with valuable patents and limited resources to be able to litigate on equal terms and promote innovation.

Third-party litigation funding (TPF) has become a real alternative for startups and SME’s to be able to face the high costs that a lawsuit may involve and to assert their intellectual property rights in an increasingly competitive global landscape. The Spanish third-party funding market is experiencing close to between 8% and 9% annual growth, driven largely by industrial property lawsuits in view of their technical complexity and the high value at stake.

Formerly confined to Anglo Saxon countries, in Europe this practice has moved on from being an emerging trend to a solid reality, helped by the Unified Patent Court (UPC), which is enabling practically pan-European large-claim lawsuits and the arrival of specialized capital willing to invest in lawsuits with high expectations of success.

Spain is increasingly taking part in this funding ecosystem, although its relatively low litigation costs compared with other countries means that there is greater capacity for self-funding. Even so, in frontrunning sectors such as life sciences or telecommunications, the extremely high technical complexity can explode costs, making access to the courts difficult for a large section of Spanish innovative business community.

1. What is litigation funding?

Third-party litigation funding involves an investor outside the lawsuit – the third-party funder – covering all or part of the costs of the court process (lawyers’ and experts’ fees, court fees and so on) in exchange for a share of the sum obtained if the proceeding is successful. In essence, the funder provides funds to the claimant or defendant to litigate and, if the judgment rules in their favor, or a beneficial agreement is achieved, the funder recoups their investment plus an agreed percentage or multiple of the sum obtained.

This tool serves two purposes. Firstly, it lowers the barriers to access to justice for patent owners with limited funds, bringing about effective judicial protection of their rights; and secondly, it provides an alternative investment model with potentially high returns for the person who takes on the financial risk of the lawsuit. In the words of the European Law Institute, third-party funders play a functionally vital role in facilitating access to justice especially where there are individual claimants with relatively small claims on one side, and a well-resourced defendant on the other.

2. Specific features of patent litigation

Patents play an essential role in the field of industrial property because they confer exclusive rights in highly valuable inventions. Lawsuits involving patent infringement or validity, however, are usually technically complex and costly, for both claimant and defendant. These disputes often require the participation of highly specialized teams on the subject concerned, together with experts (engineers, scientists, among others) and their work pushes up costs significantly. Added to this, these lawsuits tend to be very long and can take several years to complete over the first instance and appeals, which raises costs considerably.

In Europe, these proceedings have high associated costs, especially when the dispute is multijurisdictional. This factor has become particularly relevant since the Unified Patent Court (UPC) came into operation in 2023, and costs can run into hundreds of thousands of euros in the first instance.

There are also intrinsic risks that any funder (and patent owner company) must assess before commencing a patent infringement proceeding, such as the potential invalidity or restriction of the patent during the proceeding (the defendant usually responds by challenging the validity of the patent, which can leave the owner with nothing to assert), the technical complexity of the sector to which the patent belongs (which affects the expert evidence and the court’s understanding), the length and uncertainty of the process, or the difficulty with enforcing the judgment if the claim is successful (if the infringer is insolvent or in another jurisdiction, for example). All these factors impact the financial risk: a patent lawsuit can use up a huge amount of resources and end with no recompense, with an amount of compensation lower than the sum spent or even with an order for costs. Funders are therefore extremely selective about which cases they support, and demand clear signs of an infringement, high damages and a defendant with capital behind them.

3. What are the main funding models?

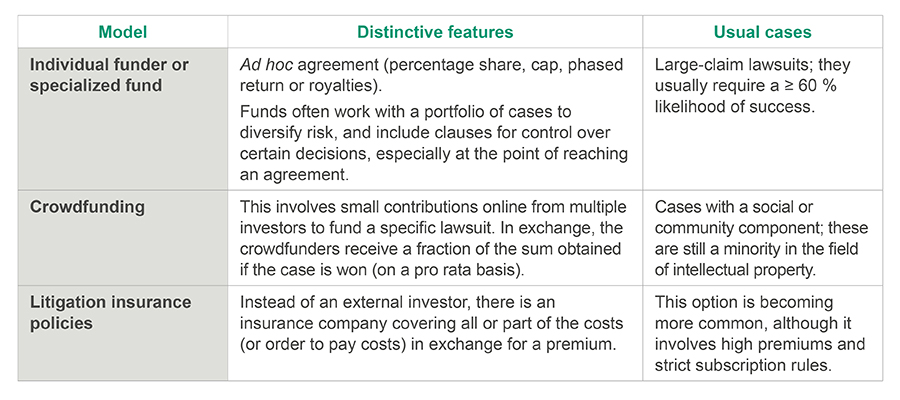

The main funding models are:

Alongside these private models, it should be mentioned that there are official organizations offering limited support to SMEs. EUIPO (European Union Intellectual Property Office) launched the IP Scan Enforcement for SMEs program offering limited support to SMEs to cover the cost of expert advisory services for defending their IP rights. This is a co-funded voucher, for a limited number of EU countries, namely Bulgaria, Croatia, Cyprus, Slovenia, Estonia, France, Latvia, Lithuania, Portugal and the Czech Republic, and for modest amounts (up to 90% of the cost of an expert within the limit applicable to the country, which ranges between 500 euros -Bulgaria- and 1,500 euros -France-). The EPO (European Patent Office) is exploring new ways of supporting SME patent owners facing potential lawsuits. In its Strategic Plan 2028 it contemplates studying a pro bono initiative to support them in early assessment of litigation risk.

4. Benefits and drawbacks

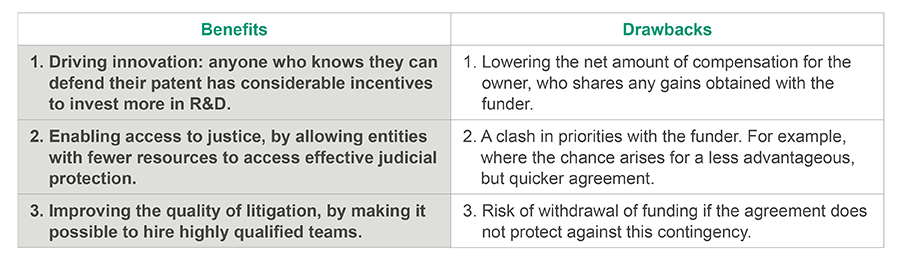

There are benefits and drawbacks to third-party litigation funding which need to be considered:

In any event, the high potential value of patents, combined with their scope of protection in terms of territory and timing, makes patent lawsuits an attractive investment opportunity for third-party funders. Unlike other types of lawsuits, patents are intangible assets, and their value is intrinsically linked to their current or future commercial use, which strengthens interest in them as a source of financial return. Therefore, if the lawsuit confirms the validity and the infringement of the patent, that asset generates income (licenses, exclusive sale of products or services among others). This means that if properly managed, a successful patent case can bring very considerable returns, justifying the interest of specialized investors.

The risks described above are usually offset by expectations of high returns, justifying the interest of funders who can also mitigate those risks by employing additional tools, such as insurance companies providing specialized products. In short, the risk / reward balance in patents is manageable for funds with experience, which explains the increase in this type of transactions.

5. Regulatory and ethics considerations in litigation funding

The absence of a general regulatory framework applicable to litigation funding and practice differences among countries has an impact on the appeal of using third-party funding, especially in lawsuits that may involve multiple jurisdictions.

In Europe, whereas most countries have no specific legislation, except in particular spheres such as on , and third-party financing is permitted with no further restrictions than those provided in civil law, others have placed obstacles, such as in Ireland where third-party funding is prohibited across the board, although it is being reviewed.

In other jurisdictions the option of self-regulation has been chosen, such as in the UK, where there is a voluntary code of conduct for funders supervised by the Association of Litigation Funders, which lays down principles such as a minimum capital requirement, withdrawal (justified or otherwise) or no interference in the lawyers’ case management.

Currently Spain does not have any general legislation on third-party funding; nor in the specific field of patents. The relationship between funder and funded party is structured using financing or assignment of receivables agreements, with freedom of contract prevailing within statutory limits. Because there is no sectoral legislation, no administrative authorization requirements exist for funds, or disclosure obligations to the court, for example. This means that parties have the freedom to agree on the terms and conditions with funders, provided they do not run counter to mandatory legal provisions. This absence of specific rules does, however, imply some uncertainty: questions such as who is responsible for paying legal costs if the case is lost or whether it is allowable to assign part of the lawsuit can be an issue if they are not agreed beforehand.

Since 2022, the European Union has taken a more active role in this field and there could be more rules on the sector in the medium term. In fact, the European Parliament issued a resolution on September 13, 2022, with recommendations to the Commission on private funding of litigation and used to prepare a proposal for a Directive Texts adopted – Responsible private funding of litigation – Tuesday, 13 September 2022. In response, the European Commission oversaw the preparation of a study on the funding of litigation in various states, which was recently published (in March 2025) –Third-Party Litigation Funding (TPLF) – European Commission-.

Meanwhile the number of specialized funds from Spain and elsewhere continues to grow. These operators are increasingly participating in lawsuits related to patents (and other IP rights), using criteria based on legal viability and expected returns to choose their cases. In particular they usually require a likelihood of success higher than 60 % (after analyzing precedents, available technical proof, etc.) and high return expectations (several times higher than the invested sum), which in practice excludes small-claim lawsuits, because they are less appealing to investors.

In this context, various international organizations have proposed key principles on litigation funding to guide lawmakers and courts. In 2024 the European Law Institute published a report on governing principles (“Principles Governing the Third-Party Funding of Litigation”). Although not confined to patents or industrial property, it provides a framework of reference for matters such as transparency (duty to disclose the existence of funding to the other side and to the court), the need to avoid the funder’s excessive control (by respecting the lawyer’s independence and the client’s decisions), the financed party’s interest prevailing over the funder’s in the event of a discrepancy, capital adequacy (the fund must have enough capital to cover the promised amount), a prohibition of funding spurious lawsuits, etc.

6. Conclusion

In a scenario where the value of the patents is often decided in the courtroom, third-party funding emerges as a tool worth considering to level the playing field and stimulate innovation. It is no longer an exotic resource, instead an increasing number of companies facing patent litigation are considering the option of involving a third-party funder to support them financially.

Although public funding mechanisms are very limited or practically nonexistent, the growth of private funding is bringing new opportunities. Funds with large amounts of capital are looking for solid cases to fund, and companies with strong patents but limited resources can find in them the chance to assert their rights.

Borja de Carlos and Mario López

Intellectual Property Department